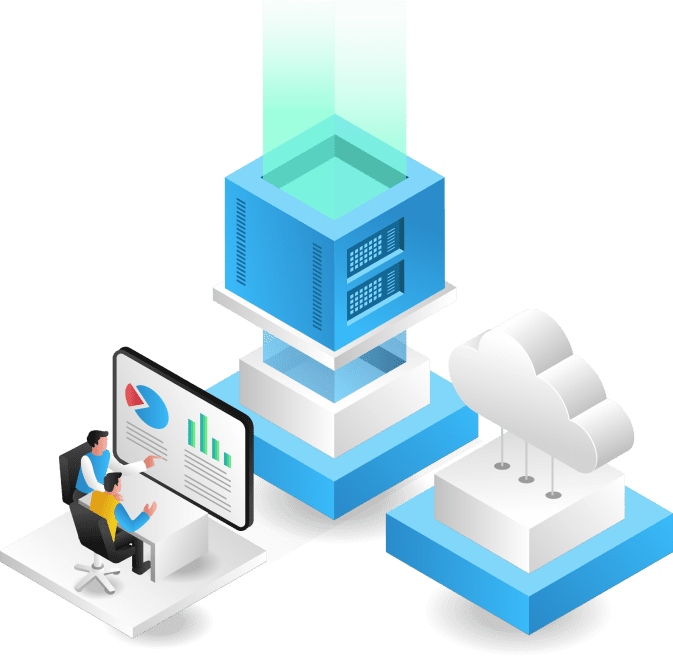

End-to-end solutions to facilitate your entry and participation

in a revolutionized borrowing and lending world.

Non-fungible tokens (NFTs) have gained significant traction and adoption globally, with billions of dollars worth of transactions taking place each month. Their use case is emerging from simply buying, selling, and holding to more intricate and profitable financial deals. One such opportunity is NFT lending, where individuals pledge their NFTs as collateral for a loan on decentralized platforms using smart contracts. The loans are provided by investors or lenders looking to earn interest on their investment. Typically, NFT-based loans offer higher returns compared to standard crypto or traditional loans. Just like with cryptocurrency lending, NFT lending relies on digital currencies as collateral. However, in NFT lending, borrowers secure their NFT assets to obtain loans. The new use case of NFTs has escalated the demand for NFT loan platform development.

The cross-functional team of blockchain experts at Antier offers end-to-end NFT loan platform development services to help businesses build powerful NFT lending platforms. We harness our technical expertise, deep domain knowledge, and breadth of experience to navigate your development process, enabling you to quickly tap into the market and gain an essential competitive edge. Whether you are a start-up or an existing borrowing or lending business seeking an opportunity to integrate blockchain into your current paradigm, our mission-driven solutions can effectively cater to your use case. Leverage our experience and expertise to steer and accelerate your NFT lending platform development process.

Borrowers use NFTs as collateral; reclaim them upon repayment. Lenders receive investment and interest.

In Peer-to-Protocol NFT lending, liquidity providers deposit tokens, and borrowers access funds by collateralizing NFTs.

Borrowers lock NFTs for loans and regain their NFTs upon repayment of the loan and interest.

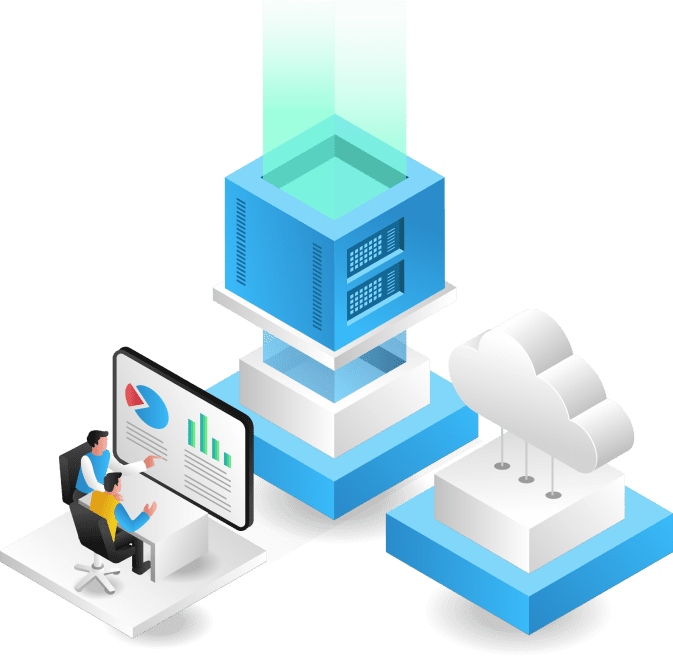

We fortify the NFT lending platform with the following features to optimize it for world-class performance, security, and user experience.

To automate the lending process, including collateral management, interest calculation, and loan repayment.

To allow for seamless crypto transactions between lenders and borrowers.

To manage the storage and transfer of NFT assets used as collateral.

To ensure legitimate user access to the platform.

To ensure a secure and legal lending environment.

To accommodate increased user traffic and handle large amounts of data as the platform grows.